QuickBooks Undeposited Funds Account Explained

Chances are you will occasionally receive payments from multiple customers and batch those into one deposit. Posting these payments to the Undeposited Funds account will allow you to correctly record the deposit in QuickBooks Online, making reconciling your bank account easier. It requires you to do an additional step in the form of multiple entries for each deposit (one to the undeposited funds account and the other to the right account). It is, however, useful for businesses that frequently get paid by check or cash and physically deposit the money to the bank instead of using mobile check deposits. I’m about to start trying to reconcile my Quickbooks to my bank’s checking account.

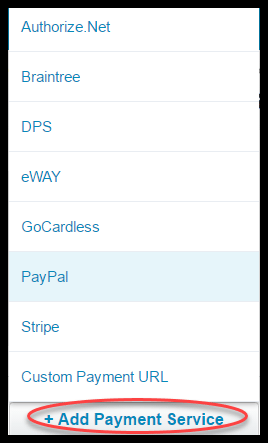

Know that apart from QuickBooks, there are a ton of other options out there that can help you offer, accept, and manage payments. When you are looking for accounting software that can help you with all your small business requirements, FreshBooks is the place to be. Created to cater to the needs of small businesses and to provide high-quality accounting services at an affordable price, FreshBooks has everything you need. It is easy to use, effortless to navigate and of course cheaper than QuickBooks.

Since both transactions were dated on Jan. 29, the first thing to check for is a deposit in your Bank Register for $2,062.52 dated on or around Jan. 29. It’s possible the deposit was posted straight to an Income account rather than matched to payments received. Also check for two separate deposits for $1,675.52 and $387, respectively. If you don’t want to use the Undeposited Funds account, you can select the bank account in the Deposit to field when creating a transaction.

This can be especially true if you are doing everything yourself, without the help of an accountant or bookkeeper. If you are not careful, you may find yourself in a difficult situation down the road when it comes time to do your taxes. QuickBooks will automatically select all of the bills that are due within the next seven days. The account has a negative balance because the money that is in the account is money that you owe.

Here, you will see a list of all the transactions that have been received but not yet deposited. This feature allows you to share bills, payments, information, and much more. First of all, Click on the plus button icon (+ icon) and Choose Bank Deposit.

As we know, reconciling is an integral part of your books and keeping them accurate. When it comes time to reconcile an account, you have your bank statement in one hand and QuickBooks Online in another. I’d be glad to share additional information about clearing up your undeposited funds account in QuickBooks Online (QBO). “This can be fixed depending on how these deposits were being deposited. Let’s go over and open the original deposit to which the account should be deposited.

The only time you’ll have to pay is when you want to upgrade your account to PLUS and get paid even faster. It’s pretty much like PayPal – minus the hassle and sophistication. As a QuickBooks ProAdvisor, I agree that the main dashboard can provide a clear sense of your organization and workflow. Using Pareto’s Principle, we know that 80% of the time, standard workflows are the order of the day.

How to Enter Electronic Withdrawals in QuickBooks

I’d suggest consulting an accountant to help and guide how to record this. Your accountant can provide more expert advice in dealing with this concern so your account stays accurate. You know where to find me if you have any other banking or deposit concerns, I’ll be always here to help you. However, I would still recommend consulting an accountant. They’ll ensure your books are accurate before and after doing the corrections. In the “Amount” field, enter the total amount of the payment.

- It also matters because it helps you ensure that your receivables and payables accurately match what has occurred in the business.

- As a QuickBooks ProAdvisor, I agree that the main dashboard can provide a clear sense of your organization and workflow.

- When you deposit a payment in your bank account, you can enter the deposit into QuickBooks Online.

- First, you’ll want to consider setting up a separate bank account, something like «Pending Payment» or «Awaiting Withdrawal,» in your Chart of Accounts.

In the Delete process, select the file, lists, or transactions you want to delete, then apply the filters on the file and then click on the Delete option. After that, apply the filters, select the fields, and then do the export. In this method, the undeposited funds are cleared and then they are sent to a dummy account. In other, you should be deleting only those entries which are not required anymore. Recurring billing is the process of automating your payment processing repetitively.

Troubleshooting and Common Issues with Undeposited Funds

This post will help you understand the purpose of an undeposited funds account, how to clear it, and how to avoid having payments automatically posted to this account. With your deposit slip in hand, you can record a bank deposit and combine the payments in QuickBooks. All payments in the Undeposited Funds account automatically appear in the Bank Deposit window. Once you are set with the deposit slip, you can do the bank deposit and then club the payment together.

Before doing so, make sure first to check if the Undeposited Funds is not in the inactive accounts. If you find that the deposit was posted straight to Income in the bank feed, un-reconcile the transaction, undo the entry and then match the transaction properly. Continue entering payments received from your customers until all payments have been entered.

What kind of Transaction can Lead to a Debit in Undeposited Funds?

The technical accounting of this procedure is credit accounts receivable and debit undeposited funds. The undeposited funds account in QuickBooks Online is a holding account for money that has been received but has not yet been deposited in the bank. This account can be used to track money that is received in payments for products or services, or money that is collected from customers as deposits.

Undeposited Funds is the default temporary holding place for money in. Now look at your bank statement and recreate the deposits that were made in real life. The first step is to create an undeposited funds account. To do this, go to the Chart of Accounts and create a new account. The account type should be Other Current Asset, and the account number can be anything you like. The Undeposited Funds account is a holding account for money that has been received but has not yet been deposited in the bank.

They can give you the best advice on handling these transactions. I’d like to know how you get on after trying the steps, as I want to ensure this is resolved for you. Once completed, you can go back to the For Review tab and match your transactions to your existing records from there. I’m happy I came across your post and was able to address your concern. It seems like there are double tracking of payments, Mona. For majority of my clients, I personally process (ACH) payments once a month.

Can I set up deposits to go directly into the bank account in QuickBooks Online?

Once you do so, the payments in the Undeposited Funds account will show in the Bank Deposit screen. Another issue is that you may not be able to track all of your income and expenses if you are not using the undeposited funds account. This can make it difficult to keep your finances in order, and it may be hard to track your profits and losses. The undeposited funds balance will show you the total amount of funds that have been received but not yet deposited.

What are the Steps for Reconciling the Deposits in QuickBooks?

Large businesses, in particular, may delay depositing money for several days because it is tedious to deposit one check at a time throughout the working week. Let’s say your customer sent you a check for services rendered. You received the check on the last day of the year, which happened Free Profit and Loss Form Free to Print, Save & Download to be a Saturday. QuickBooks Online has a special account specifically for these funds in transit. I’m joining this thread to provide steps on how you can record it, Jsimons3. The transactions not appearing in QuickBooks might be located within the Undeposited Funds account.

Next, set up the mapping of the file column related to the QuickBooks field. Dancing Numbers template file does this automatically; you just need to download the Dancing Number Template file. We provide you support through different channels (Email/Chat/Phone) for your issues, doubts, and queries. We are always available to resolve your issues related to Sales, Technical Queries/Issues, and ON boarding questions in real-time. You can even get the benefits of anytime availability of Premium support for all your issues. That’s all you need to know when using QuickBooks Undeposited Funds.

You have many accounting software options when it comes to keeping track of your business’s financial accounts. Many people enjoy using QuickBooks because it’s easy to use, has robust features, and can grow with their company. When the deposit clears the bank, you will be able to match the deposit in your bank feed. If you don’t use the bank feed function in QuickBooks Online, you will still be able to easily reconcile the deposit when you get your bank statement.

The undeposited funds account is like a cash box, or storage bin, for your business. Many companies have a credit card processor that dumps all the day’s deposits, less processing fees, into your bank account as one lump sum. If your business falls into that category, you’ll need to use the undeposited funds asset account to unravel it all. Sometimes funds are “in transit” for less than a day, as when a customer pays you with cash or a check and you take the money to your bank at the end of the day.