Budgeting vs Financial Forecasting: What’s the Difference?

Tax refunds are more reliable, but this depends in part on how good you are at calculating your own tax liability. Unless you’re on a very tight budget, you should be able to buy baseball tickets and go out to eat. Tracking your expenses does not change the amount of money you have available to spend every month; it just tells you where that money is going. The process begins by establishing assumptions for the upcoming budget period. These assumptions are related to projected sales trends, cost trends, and the overall economic outlook of the market, industry, or sector. Specific factors affecting potential expenses are addressed and monitored.

Moreover, it also invested in new recycling technologies and improved its packaging materials. You might concentrate primarily on what will make your business the most money when making a budget. Even though it’s crucial, you also need to take other things into account when making your budget. Making a budget is crucial to ensure your business has the resources it needs to run effectively. A budget, however, occasionally has drawbacks that prevent your business from growing to its full potential. Plus, you can also explore opportunities to expand business operations.

Learn more with

With a budget, you’ll find it simpler to make important choices like how much you can afford to raise salaries. You can also determine whether team members can receive bonuses and what benefits you can provide employees. If you can be incremental in your approach, you can determine how much you may need to spend.

Both budgeting and accounting are fiscal systems or processes that involve the planning, allocating, and disbursing of monetary resources. This results in an interrelationship and a need for coordination between these two fiscal disciplines. Generally, budgeting is regarded more in terms of planning and enacting a fiscal plan. However, these planning and enactment processes are dependent upon the accounting of past-year and current-year expenditures, revenues, transfers and prior year adjustments. Of the budgeting models covered here, the static model is the most common. Alternatively, companies may wish to use a rolling forecast to adjust expenditures on the fly, to ensure it’s possible to match short-term sales goals.

Enactment of the Budget

The SCO then publishes the Budgetary/Legal Basis Annual Report and the Budgetary/Legal Basis Annual Report Supplement. Among these statutes, the following four provisions require a specific linkage between the accounting and budgeting systems. A program budget is a budget for a specific program or activity such as research and development, engineering, training, marketing, or public relations. As program budgets are typically generated for activities across multiple departments these budgets cannot be used for control purposes.

- There is always a trade-off between goal congruence and involvement.

- At the end of the fiscal year, collections, disbursements, encumbrances, and payables are reported in year-end financial statements.

- When a company creates a financial forecast report, it will decide on a time frame for the forecast and then gather all past financial documents and necessary paperwork around the time frame.

- Without knowing your cash flow, you could be putting yourself into a bad financial situation and not even know it.

- Skipping or delaying payments only worsens your debt—and besides, late fees ding your credit score.

Budgeting is the process of putting a plan together to help you not only save money, but also know how to spend it. A budget can ensure you’re not overspending and you can cover necessary expenses. Have you ever tried to put together a financial plan to help you save money?

What is budgeting?

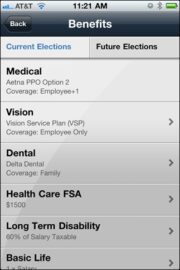

In this method, the firm identifies all of its activities, like production, distribution, advertising, etc., along with its level of operation. Then it allocates a cost to each activity based on its past consumption. Finally, the firm prepares adp benefits a budget by combining the estimated costs of each action. Activity-based budgeting is an effective and thorough way to break down different costs. Management might look at the costs incurred and try to come up with solutions to reduce them.

- Without a budget in place, a company might not be aware of how operations are going.

- You could break portions into what you need and what you want, and allocate other amounts for paying off debts.

- A cash-flow budget helps managers determine the amount of cash being generated by a company during a specific period.

- And for people whose cash flow is tight, it can be crucial for identifying expenses that could be reduced or cut, and minimizing any wasteful interest being paid on credit cards or other debt.

- The costs are separated based on their cost Behavior whether it be mixed, variable, or fixed.

For example, budgets are created to meet a goal, such as quarterly growth. Financial forecasting examines whether the budget’s target will be met or not throughout the proposed timeline. The content of a budget and financial forecast is different—the former contains specific goals like the number of items to sell or the amount of money to earn. A rolling forecast isn’t really a budget but instead of regular update to the sales forecast. The companies then model that short-term spending based on the expected sales level. A budget can be drawn up for each financial year and contain information on the estimated value of sales and value of costs.

Company

Short-term cash budgets will look at items such as utility bills, rent, payroll, payments to suppliers, other operating expenses, and investments. Long-term cash budgets focus on quarterly and annual tax payments, capital expenditure projects, and long-term investments. Long-term cash budgets usually require more strategic planning and detailed analysis as they require cash to be tied up for a longer period of time. These schedules are used to accumulate statewide totals for expenditures and revenues for the past, current, and budget years and to produce summary schedules included in the Governor’s Budget.

The financial budget refers to the budget for the balance sheet elements. The financial budget sandals the expected assets, liabilities, and stockholders equity. Budgets are based on a specific project, utilization rate and number of employees (service). The bigger the company gets, the harder it will be by simple means to create an overview of all events affecting the year. Many service providers therefore choose to budget specific projects that are currently in the company. Estimates are prepared for some time within the year, when a part of the outcome is known.

Lake County Council set to begin crafting new annual budget — The Times of Northwest Indiana

Lake County Council set to begin crafting new annual budget.

Posted: Thu, 03 Aug 2023 21:00:00 GMT [source]

If you don’t have any major savings goals (upsizing your living situation, starting your own business, etc.), it’s hard to drum up the motivation to stash away extra cash each month. However, your situation and your attitudes likely will change over time. You should always be prepared for a job loss by having at least three months’ worth of living expenses in the bank. It’s easier to accumulate this financial cushion if you know the amount you’re bringing in and spending each month, which can be monitored with a budget. Having a handle on your monthly income and expenses allows you to make sure your hard-earned money is being put to its highest and best purpose.

Naturally, if you have a large budget, some departments might feel pressured to spend the entire amount they’re allocated. This may result in overspending, which will raise your budget for the future. Many businesses will have to make important choices that will affect the flow of money in and out of business.

A master budget is a summary of your financial plan and your operating plan. The master budget gives you a “big picture” and sets your course of action for an upcoming period. Although you use historical information to put together your budget, the activities you plan happen in the future. If a company realizes that it will not be able to cover its expenses with future cash flows, it might need to consider borrowing and budget the interest expenses. A surplus budget is a plan with incomes exceeding expenditures during a certain period. In surplus budgets, expenses can be fully covered by incomes, and the residuals can be saved for future use.

The specifics of your budget will depend on your personal financial situation and goals. In most cases, though, the steps for creating a budget are the same. Many budgets are prepared on electronic spreadsheets, though larger businesses prefer to use budget-specific software that is more structured and so is less liable to contain computational errors. Budgeting software also contains controls that prevent a budget model from being tampered with by an unauthorized user.

For example, a company sets an output target of $100 million in revenues. The company will need to first determine the activities that need to be undertaken to meet the sales target, and then find out the costs of carrying out these activities. An encumbrance is a particular use of tax revenue that may or may not be paid for when the municipality makes the encumbrance. Most governments only receive tax revenues at specific times during the year. An encumbrance allows the agency or municipality to pay for goods using an accounts receivable, i.e. credit payment, system.